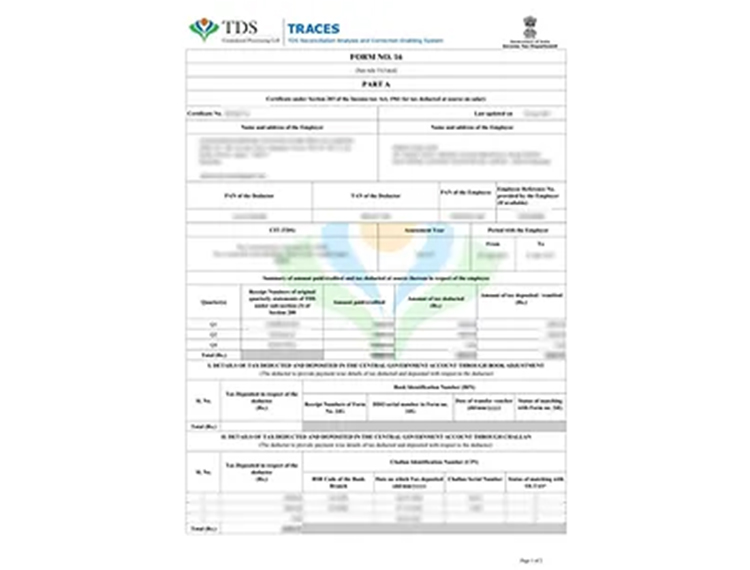

TDS Return Filing

Filing your TDS (Tax Deducted at Source) returns can be complex and time-consuming. However, at MSMElaunchpad, we’re here to make it easy for you. Our team of experienced tax professionals specializes in TDS return filing, providing comprehensive assistance and guidance to ensure your TDS compliance needs are met efficiently.

₹3389 excl. GST (Annual Price)

Why Choose MSMElaunchpad for your TDS Return Filing?

1. Expert Guidance:

Our team of tax professionals understands the intricacies of TDS laws and regulations. We stay up-to-date with the latest changes to ensure that your TDS return is prepared accurately and in compliance with the requirements of the Income Tax Department.

2. Comprehensive TDS Compliance:

TDS compliance involves various tasks, such as deducting the correct TDS amount, issuing TDS certificates, and filing TDS returns within the specified deadlines. MSMElaunchpad ensures that your TDS compliance is handled seamlessly, avoiding penalties or legal complications.

3. Error-Free Filing:

Accuracy is crucial when it comes to TDS return filing. Our professionals meticulously review all financial information, verify TDS calculations, and double-check every detail to minimize errors. As a result, we ensure that your TDS return is filed correctly, reducing the chances of any discrepancies or audit queries from the tax authorities.

4. Timely Filing:

We understand the importance of meeting TDS return filing deadlines. Our team works diligently to prepare and file your TDS return within the specified time frame, ensuring that you avoid any penalties or late filing fees. In addition, we handle all the paperwork and submissions, allowing you to focus on your core business activities.

5. Compliance with TDS Laws:

We understand the importance of meeting TDS return filing deadlines. Our team works diligently to prepare and file your TDS return within the specified time frame, ensuring that you avoid any penalties or late filing fees. In addition, we handle all the paperwork and submissions, allowing you to focus on your core business activities.