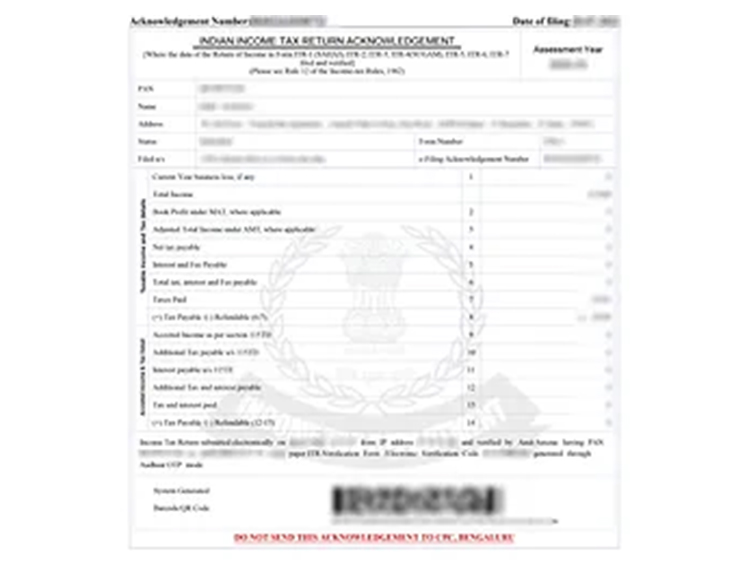

ITR-7

Filing your income tax return as a person with income derived from properties held under trust, political parties, research associations, news agencies, or any other specified entities can be complex. But worry not because, at MSMElaunchpad, we specialize in providing comprehensive assistance and guidance tailored explicitly to ITR-7, ensuring that your tax filing process is streamlined and accurate.

₹4236 excl. GST

Why Choose MSMElaunchpad for your ITR-7 Filing?

1. Expert Guidance

Our team of experienced tax professionals understands the intricacies of ITR-7 and the unique challenges faced by individuals and entities covered under this form. We stay up-to-date with the latest tax laws and regulations to ensure that your ITR-7 is prepared accurately and in compliance with the requirements of the Income Tax Department.

2. Asset and Investment Reporting

ITR-7 also requires reporting your entity’s investments, assets, and liabilities. Again, our experts will assist you in accurately writing your holdings, including stocks, mutual funds, real estate, foreign assets, and more. As a result, we ensure that you fulfil all reporting requirements while optimizing your tax liability.

3. Deduction Optimization

ITR-7allows for various deductions and exemptions that can help reduce your entity’s taxable income. MSMElaunchpad’s professionals will review your financial situation and identify eligible deductions and exemptions to optimize your tax liability. As a result, we ensure you take full advantage of all available tax benefits, maximizing your savings within the legal framework.