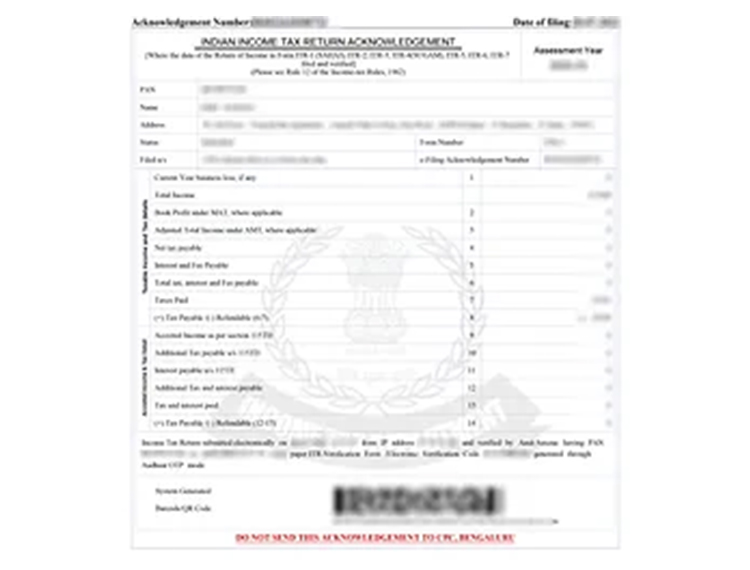

ITR-6

Filing your income tax return as a company can be complex, with specific reporting requirements and compliance obligations. But worry not because, at MSMElaunchpad, we specialize in providing comprehensive assistance and guidance tailored explicitly to ITR-6, ensuring that your tax filing process is streamlined and accurate

₹6355 excl. GST

Why Choose MSMElaunchpad for your ITR-6 Filing?

1. Expert Guidance

Our team of experienced tax professionals understands the intricacies of ITR-6 and the unique challenges companies face. We stay up-to-date with the latest tax laws and regulations to ensure that your ITR-6 is prepared accurately and in compliance with the requirements of the Income Tax Department.

2. Compliance with Tax Laws

Companies have specific compliance requirements under the Income Tax Act, including tax audit reports, transfer pricing regulations, and maintaining books of accounts. Our experts will ensure you fulfil all the necessary compliances, adhering to tax provisions applicable to your company.

3. Company Income Reporting

ITR-6 requires detailed reporting of your company’s income, deductions, and expenses. MSMElaunchpad’s experts will assist you in accurately reporting your company’s financials, ensuring that you comply with tax laws while optimizing your tax liability.

4. Error-Free Filing

Accuracy is crucial when filing your ITR-6. Our meticulous approach and attention to detail ensure that your company’s tax return is error-free, minimizing the chances of any discrepancies or queries from the tax authorities. We double-check all the information provided, including PAN details, bank account numbers, and tax calculations, to ensure a smooth and error-free filing process.